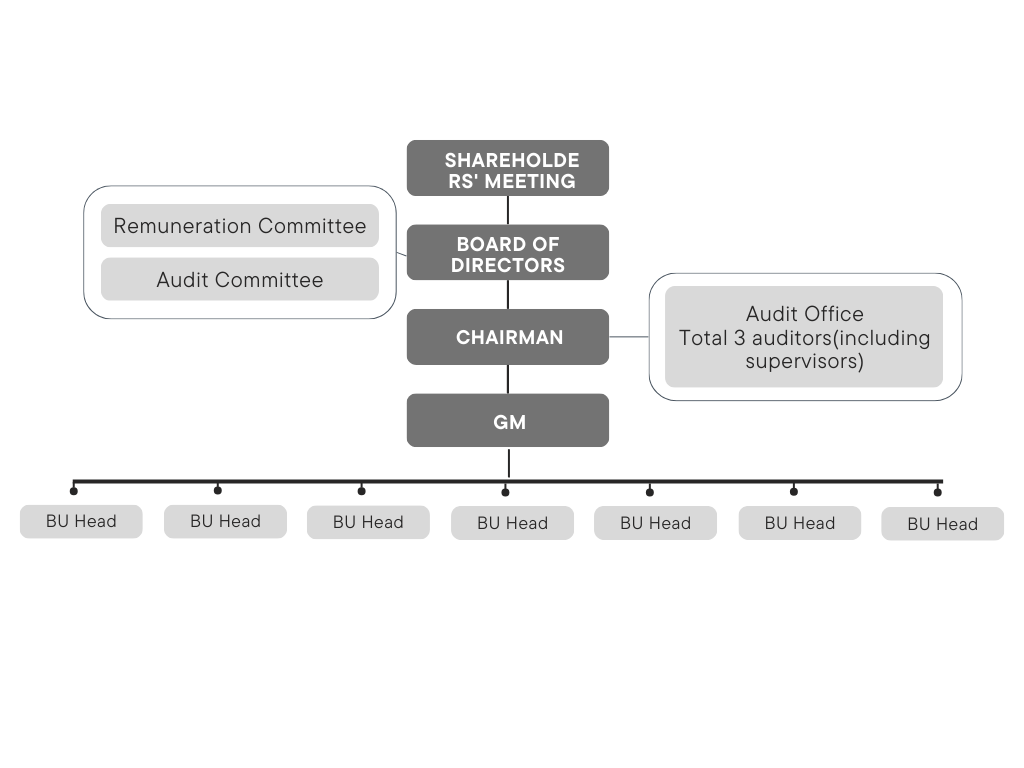

Audit Scheme

The Internal Audit is an independent unit under the Board of Directors; Job function includes monthly performance report to the Audit Committee, as well as a summarized report in the Board of Directors routing meeting.

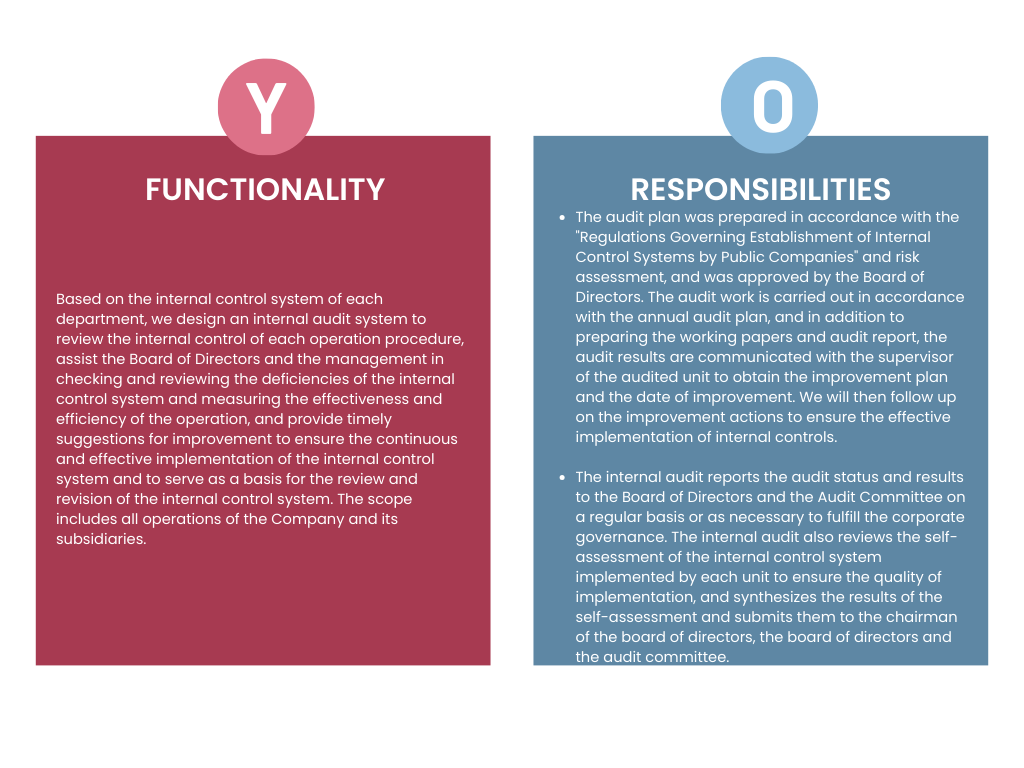

Communication channels between independent directors and the head of internal audit

The Head of Internal Audit reports quarterly to the independent directors on the results of audit engagements and tracking reports on the progress of implementation.

Discussing internal controls and issues of concern to the independent directors with members of the Audit Committee through electronic communication and meetings on a regular basis.

Meetings may be called at any time in the event of a significant unusual event.

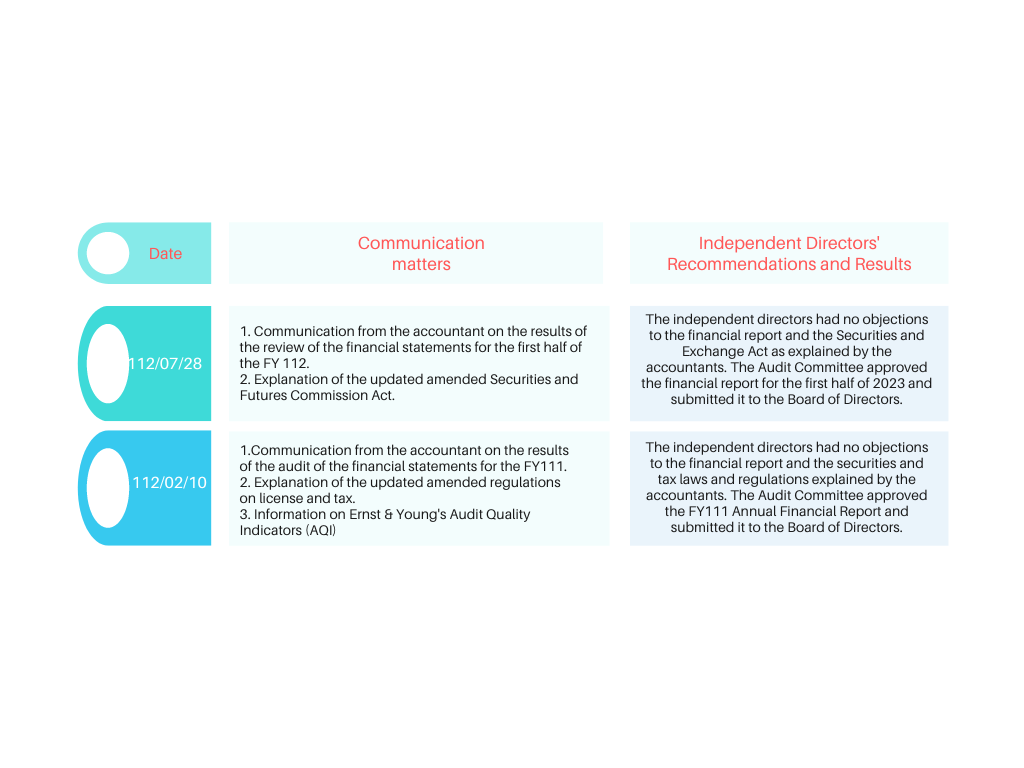

Policy Communication between Independent Directors and Accountants

The accountants shall report to the independent directors at least twice a year on the results of financial statement audits, new amendments to the Securities and Exchange Commission and tax laws and regulations, and international financial reporting standards to be applied.

To communicate with the independent directors from time to time as appropriate.